Gross Profit vs Net Profit: Which is more important for your business?

![]()

As a business owner, you're always looking for ways to increase profit. But did you know that there's more than one type of profit? In fact, there are two main types of profit that are used to assess a business's financial health: gross profit and net profit. But what's the difference between gross profit vs net profit?

In short, gross profit measures a business's ability to generate revenue from its core product or service offering, while a company's net profit measures its overall profitability. While they may seem similar at first glance, there are some key differences between gross profit and net profit that every business owner should be aware of. Plus, there’s a specific way to measure your gross profit if you’re a service business that will ensure you get meaningful insights and can benchmark your performance against other service businesses. Let's take a closer look.

What is gross profit?

Gross profit is a narrower measure than net profit. It is defined as your company's revenue minus the cost of goods sold (COGS). The gross profit margin is a company's gross profit divided by its net sales, so the amount of money you make from selling your products or services minus the direct costs associated with making or acquiring those products or services. Gross profit - also sometimes referred to as ‘gross margin’ - is a good measure of your company's overall profitability.

How to calculate gross profit?

For example, let's say that your business sells widgets for £100 each. The cost of materials for each widget is £50 and the cost of labour is £20. Your gross profit would be £30 per widget (£100 - £50 - £20 = £30), meaning your gross profit percentage would be 30% ((£30 / £100) x 100)

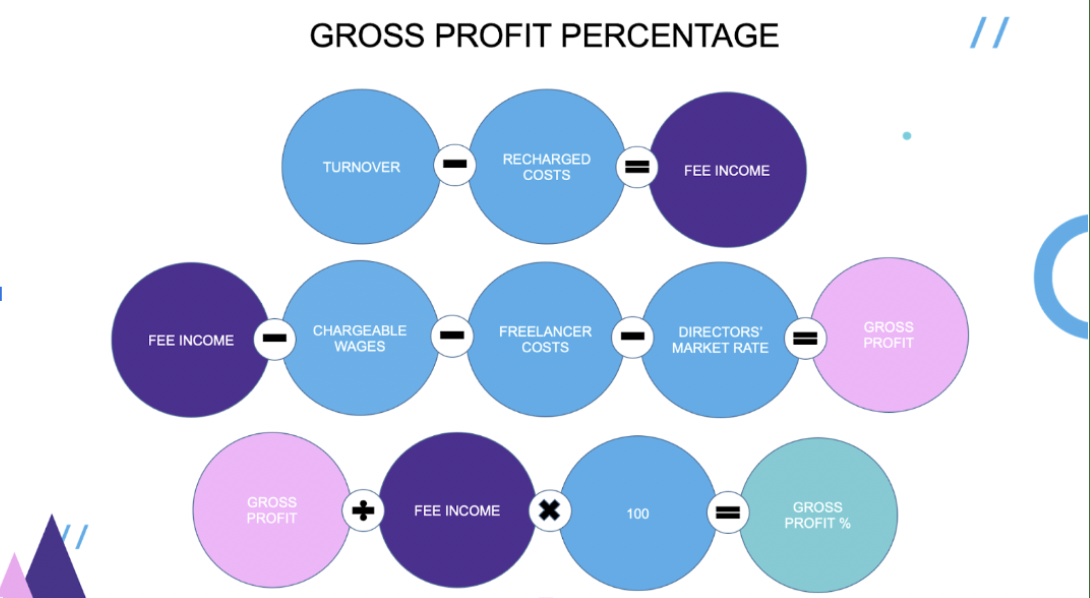

Calculating your company's gross profit for service businesses

If you’re a service business, most of the cost of delivering your service will be in the salaries of the people that deliver that service. Some businesses categorise these salaries as overheads, rather than COGS. If you do this too, you’re not getting a true picture of how profitable the services you offer are. To calculate this properly, use the gross profit formula below. You can also watch this short video.

Service businesses: Aim for a gross profit of 50% or more

Calculating your gross profit percentage in this way will allow you to benchmark yourself to other service businesses. Aim for a gross profit percentage in excess of 50%. If you achieve this benchmark, you’re well on your way to building a profitable and sustainable service business.

What is net profit?

Net profit, on the other hand, is your gross profit minus operating expenses. Your operating expenses include fixed costs like rent, utilities, insurance, marketing, and salaries for your staff that aren’t directly involved in the delivery of your goods or service. Net profit - sometimes referred to as ‘net income’ is a good measure of your company's bottom line. In other words, net profit has a much broader scope than gross profit and makes it a more holistic measure of a business's overall profitability because it takes into account other expenses, such as income taxes and overheads. Ultimately, it tells you how much money you actually have available to reinvest in your business or take home as dividends.

How to calculate net profit?

Let’s say a business has a turnover of £1m. Using the gross profit calculation above, it has a gross profit percentage of 55%, so makes £550k or gross profit. When you add up all its other costs (operating expenses), these come to £350k, leaving a net profit of £200k. This means the business has a net profit percentage of 20% ((£200k / £1m) x 100).

Why gross profit matters to your business?

Gross profit is important because it gives you a snapshot of your company's profitability before operating expenses are taken into account. This number can be helpful in a number of ways:

Firstly, it can help you evaluate whether or not your products or services are priced correctly. If your gross profit margin is too low, it could be an indication that you're not charging enough for what you're selling. On the other hand, if your gross profit margin is too high, it could mean that your team are overstretched in delivering the work, which might not be sustainable. Secondly, gross profit can also be used to track the profitability of individual products, services, clients, projects, or even team members. This will allow you to work out where you’re making profit (and where you’re losing it). Finally, gross profit can help you secure funding from investors or lenders. When evaluating whether or not to give you money, potential investors and lenders will want to see proof that your business is profitable, and gross profit is one of the first numbers they'll look at. If your gross profit margins are healthy and trending in the right direction (up!), then you'll have a much better chance of getting the funding you need to grow your business.

Why net profit is important to your business?

Net profit is also an important indicator of a company's financial health and is typically what's reported on a company's income statement. Financial statements like the income statement help investors and analysts understand a company's overall financial health, so when evaluating a business, investors and analysts often closely examine net profit figures. A healthy net profit margin indicates that a company is profitable and has room to grow. Net profits can be used to reinvest in the business, pay dividends to shareholders, or even pay down debt. Conversely, a low net profit margin can be a sign that a company is struggling to make ends meet and may face cash flow issues. For this reason, it is essential for business owners to monitor net profit margins closely. By doing so, you can identify potential problems early on and take steps to improve your profitability.

What is a good net profit margin?

We’ve already established that a good gross profit margin for service businesses is 50% or more. But what about net profit margin? What ‘good’ looks like here very much depends on the size of your business. Your net profit percentage is likely to reduce as your business grows. This is because you’ll add more operating expenses that you don’t need when you’re smaller, e.g. offices, non-chargeable staff, infrastructure, etc.

For businesses under £1m turnover, most will be making between 10% - 30% net profit margin. For business £1m - £10m turnover, this drops to between 5% - 25% net profit margin. However, in both cases, there are businesses making much more net profit than this. Anything above 30% is considered high-performing.

As well as differing based on size of business, profit margins will vary depending on the industry and the type of product or service being offered. For example, companies in the food and beverage industry typically have lower profit margins than businesses in the technology sector. Ultimately, each business needs to determine what profit margin is right for them based on their individual circumstances.

It's also important to remember that gross and net profit margins are just one financial metric. They should be considered alongside other measures, including ensuring that you’re measuring the three key types of metrics:

Other metrics to measure

Retrospective

Sometimes called lagging indicators, these show you what has already happened, e.g. sales for the month or cash in the bank.

Real-time

These metrics show you what is happening right now, e.g. profitability on live projects, website sales today, or team utilisation rates this week.

Predictive

Sometimes called leading indicators, these tell what is going to happen in the future, e.g. the number of website visits might be a leading indicator of the number of sales conversations you’re going to have, which is a leading indicator of the number of proposals you’ll issue, which is a leading indicator of what your sales might be in the future. The key is to work out which leading indicators are the biggest determinants of your future success (and profitability).

Looking to increase your profit? We’d love to help

If you’d like to explore how you can increase your profit or have any additional questions on gross profits vs net profits, please get in touch. We’d love to help.